The Saba Capital Income & Opportunities Fund (NYSE:BRW) is a closed-end fund, or CEF, that income-focused investors can purchase as a method of achieving their goals of earning a very high level of current income from the assets in their portfolios. The fund certainly does quite well at this task, as it currently boasts a whopping 14.51% yield based on the most recent closing price. This is among the highest yields available from any closed-end fund in any sector, which regular readers can probably see. It is certainly higher than the yield available from many of the fund’s peers:

|

Fund Name |

Morningstar Classification |

Current Yield |

|

Saba Capital Income & Opportunities Fund |

N/A |

14.51% |

|

High Income Securities Fund (PCF) |

Fixed Income-Taxable-Convertibles |

10.86% |

|

Cohen & Steers Closed-End Opportunity Fund (FOF) |

Hybrid-U.S. Allocation |

8.71% |

|

Doubleline Opportunistic Credit Fund (DBL) |

Fixed Income-Taxable-Multi-Sector Bond |

8.59% |

|

PIMCO High Income Fund (PHK) |

Fixed Income-Taxable-Multi-Sector Bond |

11.85% |

* Morningstar does not specify on its website which category it has assigned to the Saba Capital Income & Opportunities Fund. Curiously, it does include category comparisons for this fund, but it does not explicitly state which other funds are included in the comparison. As we will see throughout this article, it is very difficult to put a category description on this fund because it has a tendency to change its assets and types of assets fairly significantly from period to period.

As we can clearly see here, the Saba Capital Income & Opportunities Fund has a substantially higher yield than any of its peers. While this is something that will undoubtedly appeal to anyone who is seeking to earn a very high level of income, it is a good idea to use caution when approaching a fund with an outsized yield. The only other funds whose yield matches this one are funds that fairly regularly pay out distributions that are not fully covered by their investment income. As such, the distribution might not be sustainable. We will want to investigate this as part of our analysis today, as most income investors do not want their income to suddenly decline with no warning.

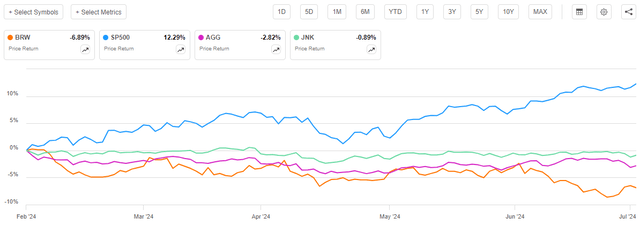

As regular readers can likely remember, we previously discussed the Saba Capital Income & Opportunities Fund back in early February 2024. The equity market in general has been pretty strong since that time, but domestic bonds have not performed especially well. This fund invests in both equities and bonds, though, so we can expect that the fund would shift its holdings in a direction where it would maximize its returns. Thus, we might expect that the fund will have delivered a reasonably solid performance. However, that has not been the case, as shares of the fund are down 6.89% since that previous article was published:

Seeking Alpha

We can immediately see that the fund underperformed the S&P 500 Index (SP500) by quite a lot. This is not particularly surprising, though, as very few closed-end funds manage to beat the S&P 500 Index on a price basis. However, this fund also underperformed both investment-grade bonds (AGG) and junk bonds (JNK) over the period. This is much more disappointing, especially considering the reputation that Saba Capital has with many investors.

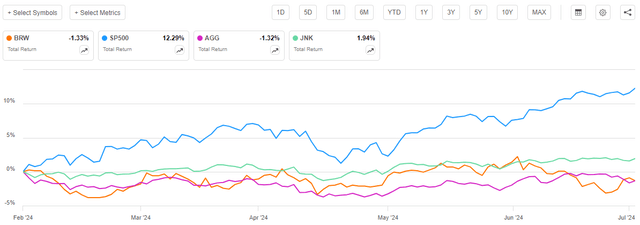

However, the above chart might be misleading. As I pointed out in a previous article:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

When we include the distributions that were paid out by the Saba Capital Income & Opportunities Fund since February, we get this alternative chart:

Seeking Alpha

This certainly looks much better for this fund. As we can see here, on a total return basis, it roughly matched the total return of investment-grade bonds. In fact, until early June, the fund was fairly consistently beating investment-grade bonds. However, it still underperformed junk bonds and large-cap domestic stocks, which is quite disappointing. Overall, we can see that the fund’s performance was not as bad as it appeared at first glance, but it still performed much worse than many other funds that did not lose money during the period in question.

As five months have passed since we last discussed the Saba Capital Income & Opportunities Fund, we can expect that there have been a great many changes. Most importantly, the fund released its semi-annual report last night that details its performance during the massive market rally at the end of last year and also covers the first few months of this year. As such, we will want to pay very close attention to this report, as it could be critical to determining whether it still makes any sense to hold this fund.

About The Fund

According to the fund’s website, the Saba Capital Income & Opportunities Fund has the primary objective of providing its investors with a very high level of current income. The website also states that the fund has a secondary objective of providing capital appreciation. However, the website does not really provide an in-depth description of how the fund will achieve these objectives. All it states is:

The Fund invests globally in debt and equity securities of public and private companies, which includes, among other things, investments in closed-end funds, special purpose acquisition companies, reinsurance, and public and private debt instruments.

The website also states that the fund might invest up to 15% of its assets into private funds, such as hedge funds. This makes it one of the very few funds that can or will invest in such alternative assets. As we have seen in various previous articles, the overwhelming majority of closed-end funds stick to investing solely in traditional liquid assets such as stocks and bonds.

The fund is currently using its ability to invest in private funds, as we can immediately see by looking at the largest positions in the fund:

Saba Capital

The Stone Ridge Opportunities Fund is a private fund that we mentioned in a previous article on this fund. As I stated in that article:

The largest position is actually a hedge fund managed by Stone Ridge. While it is difficult to find any information about this particular fund online, Stone Ridge itself focuses heavily on alternative capital funds and similar things. The fund’s semi-annual report states that this fund invests in catastrophe bonds and similar assets that reinsurance companies use to ensure that they are not completely wiped out in the event of a severe disaster. These things represent a class of assets that can be very hard to get access to, particularly for non-accredited investors.

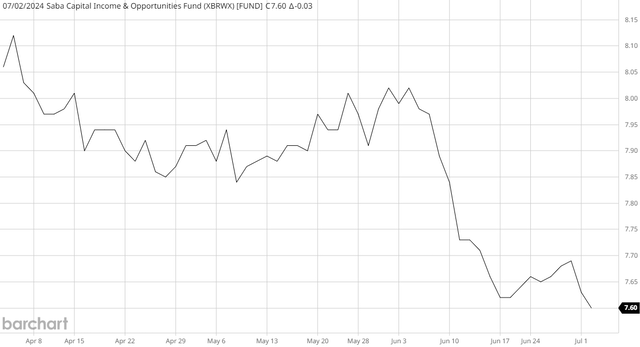

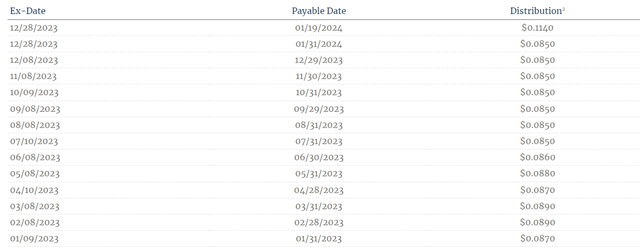

This position may have been at least partially responsible for the steep decline in net asset value that the Saba Capital Income & Opportunities Fund suffered in June. As we can see here, the fund’s net asset value fell from $8.02 per share on June 4, 2024, to $7.62 on June 17:

Barchart

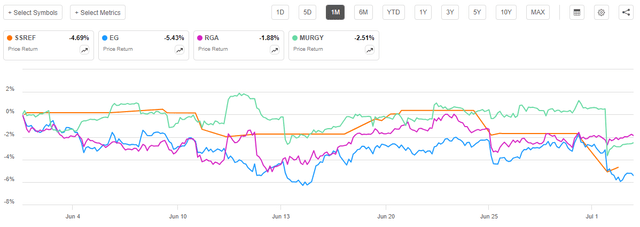

That is a 4.99% decline in about two weeks. This is the thing that was largely responsible for the fund’s terrible performance that we saw in the introduction to this article, as this fund was generally performing similarly to the major bond indices until early June. The one-month price chart of a few major reinsurance companies backs this up:

Seeking Alpha

The companies shown in the chart above are Swiss Re (OTCPK:SSREF), Everest Re (EG), Reinsurance Group of America (RGA), and Munich Re (OTCPK:MURGY). We can immediately see that most of them took very significant hits to their stock prices in either June or July. This is probably due to the predictions that 2024 will be a fairly active year for Atlantic hurricanes. From Yahoo! Finance:

Issuance of catastrophe bonds just hit a record high as the market braces for a rough hurricane season with the potential to do catastrophic damage.

Sales of so-called cat bonds are 38% higher this year through May than over the same five-month period in 2023, which was already a record, according to Artemis, a compiler of data on insurance-linked securities. What’s more, the $4 billion issued in May alone represents the greatest volume of catastrophe bonds ever sold in a single month, Artemis said.

The development looks set to reshape a market that last year supported the world’s best-performing hedge-fund strategy. Cat bonds, which allow insurers to transfer risk to the capital markets, can leave an investor with huge losses if catastrophe hits, and huge gains if it doesn’t. In 2023, cat bonds soared 20%, marking the best annual return in their almost three-decade history.

Now, some veteran catastrophe bond investors are looking for ways to cut their exposure as forecasts predict a particularly active hurricane season.

Hurricane Beryl is currently churning in the Caribbean Sea, with meteorologists assigning it either a Category 4 or a Category 5 rating, depending on when its wind speed is measured. This is the earliest tropical storm ever recorded to reach that level of intensity. Thus, the market is clearly preparing for massive losses in the insurance and reinsurance industries, which explains the substantial stock price declines of some of the world’s largest reinsurance companies. It would also make sense for catastrophe bonds to take a hit as investors start to expect that these bonds will impose losses upon their holders as this year’s hurricane season results in devastation throughout the Caribbean and potentially even coastal regions of the United States. As a significant proportion of the Saba Capital Income & Opportunities Fund’s assets are invested in a hedge fund that invests its assets in catastrophe bonds that are taking money, it would be understandable that this situation would also cause the fund’s net asset value to suffer some destruction. Unfortunately, the Stone Ridge Opportunities Fund is a private fund, so it can be difficult for the fund to move out of this position, and it would have to realize losses if it did that in any case. Thus, our only real option as investors in the Saba Capital Income & Opportunities Fund is to either sell our shares (and realize losses ourselves) or stand pat and hope that the managers of that hedge fund are capable enough to avoid losing too much money. Personally, I am opting to hold my shares and possibly even buy some more on dips, but my risk tolerance may differ from yours.

As was the case the last time that we discussed the Saba Capital Income & Opportunities Fund, the largest asset class that is held by the fund is other closed-end funds:

|

Asset Class |

% of Net Assets |

|

Closed-End Funds (Globally) |

33.35% |

|

Senior Secured First Lien Loans |

14.57% |

|

Private Fund |

11.99% |

|

Common Stock |

8.14% |

|

Senior Unsecured Loans |

7.63% |

|

Unit Trust |

7.24% |

|

Senior Secured Loans |

5.00% |

|

Agency Securities |

1.14% |

|

Preferred Stock |

0.94% |

|

Options |

0.62% |

|

Second Lien |

0.56% |

|

Futures |

0.44% |

|

Total Return Swap |

0.20% |

|

Special Purpose Acquisition Company |

0.13% |

|

Warrants |

0.08% |

|

Secured Second Lien Loans |

0.03% |

|

Futures |

-0.01% |

|

Preferred Stock |

-0.02% |

|

Swaption |

-0.23% |

|

Agency Forwards |

-0.40% |

|

Unit Trust |

-4.21% |

|

Common Stock |

-9.18% |

|

Credit Default Swap |

-10.15% |

|

Government Bond |

-49.30% |

|

Cash, Cash Equivalents, & Other Net Assets |

81.45% |

(all figures from the fund sponsor.)

This fund clearly has massive short positions in government bonds. That could prove problematic if the Federal Reserve cuts interest rates in the near future. After all, an interest rate cut would result in these assets increasing in price, and short positions are negatively impacted by rising asset prices. The market has been predicting interest rate cuts for a while now, but it is far less optimistic about the magnitude of the impending cuts than it was back around the start of the year. Treasury notes and bonds are generally down since January, so the fund has profited from this short position thus far. This might account for part of the weighting change that we see in the short government bond position when compared to the level that this fund had at the time of our previous discussion. In the previous article, the fund had a -47.61% weighting to government bonds. The fact that this figure increased when compared to the previous article means that one of two things happened:

The bonds that the fund shorted declined in price, increasing the relative value of its short position when compared to the remainder of the portfolio. The fund shorted more government bonds than it had previously.

Either of these options is a possibility, but it seems likely that the fund’s management would not significantly increase its position by going short more government securities than previously. Thus, option one appears to be more likely to be correct in this instance. In either case, though, the fund seems to have a higher value of outstanding short securities today than it had five months ago.

Leverage

As is the case with most closed-end funds, the Saba Capital Income & Opportunities Fund employs leverage as a method of boosting the effective yield and total return that it earns from the assets in its portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and uses that borrowed money to purchase closed-end funds, bonds, or other income-producing assets. As long as the purchased assets deliver a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case.

With that said, this strategy is not as effective today with rates at 6% as it was two years ago when rates were at 0%. We have already seen other funds run into trouble because of the rising expenses related to their leverage.

The use of debt is a double-edged sword because leverage increases both gains and losses. As such, we want to ensure that the fund is not using too much leverage because that would expose us to too much risk. I generally do not like a fund’s leverage to exceed a third as a percentage of assets for this reason.

As of the time of writing, the Saba Capital Income and Opportunities Fund has leveraged assets comprising 20.98% of its portfolio. This represents a substantial increase from the 13.26% leverage that the fund had the last time that we discussed it. The fact that this fund’s leverage increased over the period is not especially surprising. After all, this was one of the few closed-end funds that experienced a substantial decline in net asset value over the past five months:

Barchart

This chart shows the fund’s net asset value from February 1, 2024 (the publication date of my previous article on this fund) until today. As we can see, the fund’s net asset value declined, which means that its portfolio is 6.52% smaller today than it was back in early February. If the fund’s outstanding borrowings remained stable, then the amount of money that it owes to its creditors will now be higher than it owed five months ago. This appears to be what happened to this fund.

Despite the increase in the fund’s leverage over the past few months, we can clearly see that it remains well below the one-third of assets levels that I would ordinarily find acceptable. This is a positive sign, but it does not necessarily mean that the fund is not employing too much leverage. After all, more volatile strategies require that a fund maintain a lower level of leverage to keep its risk at a reasonable level. Thus, we should compare this fund to its peers in an attempt to determine if its leverage is acceptable for the portfolio risk:

|

Fund Name |

Leverage Ratio |

|

Saba Capital Income & Opportunities Fund |

20.98% |

|

High Income Securities Fund |

0.00% |

|

Cohen & Steers Closed-End Opportunity Fund |

0.00% |

|

DoubleLine Opportunistic Credit Fund |

12.62% |

|

PIMCO High Income Fund |

15.92% |

(all figures from CEF Data.)

We can immediately see that the leverage ratio of the Saba Capital Income & Opportunities Fund is significantly higher than that of the fund’s peers. This suggests that its current level of leverage is higher than is appropriate for the fund’s strategy, and thus it may be exposing its investors to an excessive level of risk.

However, when we consider that the fund’s recent net asset value decline was almost certainly driven by a steep decline in the value of catastrophe bonds and that the remainder of its portfolio appears to be okay, we can see that we probably do not need to worry too much about the fund’s leverage at its current level. We certainly do not want this fund to suffer any more losses, though, as the fund’s leverage will amplify the size of these losses and that will result in the fund’s investors suffering to an even greater degree than they already have.

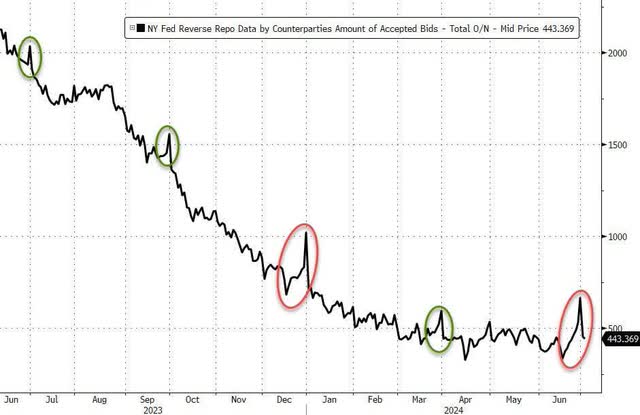

The fund’s portfolio outside the catastrophe bond position appears to be biased towards the scenario in which the Federal Reserve does not cut interest rates to any significant degree in the near future. We can see this in the fact that the fund maintains a significant weighting towards first- and second-lien secured and unsecured loans, while maintaining a short position to investment-grade government bonds. While it is currently my base case scenario that there will be no interest rate cuts until December, there was an event earlier this week that could pose a risk to that scenario. This is that the usage of the Federal Reserve’s reserve repo facility declined by $220 billion since the end of June:

Zero Hedge

As Zero Hedge explains:

Usage of the Fed’s Reverse Repo facility is down $220 billion in the last two days as the massive surge in demand across month-end and quarter-end pulls back (mirroring December’s stress and not the prior quarter-ends), but notably this pull back is far less than the $313 billion drop seen at 2023 year-end (suggesting that banks are clinging to the liquidity a little more than normal)…

The secured overnight financing rate also jumped by seven basis points on July 1, 2024. This could all suggest that banks are weak on liquidity and lending capacity, which might prompt the Federal Reserve to start making it easier for banks to obtain financing through the discount window by lowering interest rates. There is no guarantee that this would be the case, though, as the Federal Reserve could also address this situation by further reducing the pace of sales of the Treasury securities on its balance sheet.

In addition to this, ADP payroll data was released earlier today and it disappointed. There is a non-zero chance that the Federal Open Market Committee will use this data as an excuse to cut interest rates at its meeting later in July to protect itself from political accusations of trying to influence the presidential election if it cuts in September. While this scenario is still not the base case scenario, it is a risk that investors in this fund could face, and it would result in investors taking two hits in a row (the catastrophe bonds and then a month later an interest rate cut). The fund’s leverage would increase these losses, and therefore we should not ignore this risk.

Distribution Analysis

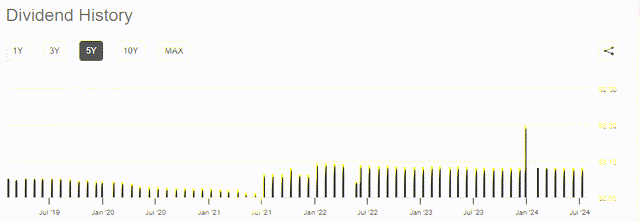

The primary objective of the Saba Capital Income & Opportunities Fund is to provide its investors with a very high level of current income. To this end, the fund makes a regular monthly distribution of $0.085 per share ($1.02 per share annually). This gives the fund a whopping 14.51% yield at the current share price.

The fund has not been particularly reliable regarding its distribution over the years:

Seeking Alpha

However, around the middle of last year, the fund implemented a managed distribution policy that gave it a reliable payout at the current level:

Saba Capital

Notice how the fund’s distribution changed from a variable distribution to a fixed distribution in July 2023. This is due to the managed distribution program, which the fund explains in its latest distribution announcement:

The above distribution was declared in accordance with the Fund’s currently effective managed distribution plan, whereby the Fund will make monthly distributions to shareholders at a fixed amount of $0.085 per share. Thus, the distribution amount shown excludes special distributions (which are not paid pursuant to the plan), including the special dividend paid during the current fiscal period in January 2024. The Fund will generally distribute amounts necessary to satisfy the Fund’s Plan and the requirements prescribed by excise tax rules and Subchapter M of the Internal Revenue Code. The Plan is intended to provide shareholders with a constant, but not guaranteed, fixed minimum rate of distribution each month and is intended to narrow the discount between the market price and the net asset value of the Fund’s common shares, but there is no assurance that the Plan will be successful in doing so.

Under the Plan, to the extent that sufficient investment income is not available on a monthly basis, the Fund will distribute long-term capital gains and/or return of capital in order to maintain its managed distribution rate. As a result, long-term capital gains and/or return of capital may be a material source of any distribution. No conclusions should be drawn about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the Fund’s plan.

Thus, we can basically always expect that this fund will distribute $0.085 per share, even if it cannot actually afford it. As such, it is critical that we take a look at the investment performance of the fund’s portfolio to ensure that it is not paying out more than it can actually afford. After all, if the fund is continually over-distributing, it will eventually have to cut the payout because otherwise, it will run out of money.

As stated in the introduction, the fund released an updated financial report yesterday. This report corresponds to the six-month period that ended on April 30, 2024. As such, this is obviously a much newer report than the one that was available to us the last time that we discussed this fund. This is very nice for update purposes, especially considering that many investors might be worried about the very high distribution yield that this fund possesses compared to other funds in the market.

For the six-month period, the Saba Capital Income & Opportunities Fund received $16,118,608 in interest and $6,217,816 in dividends from the assets in its portfolio. This gives the fund a total investment income of $22,336,424 for the period. The fund paid its expenses out of this amount, which left it with $11,625,271 available for shareholders. This was not sufficient to cover the $26,550,738 that the fund paid out in distributions during the period.

This fund was, unfortunately, not able to make up the difference via capital gains. For the six-month period, the fund reported net realized losses of $33,125,947 that were partially offset by $30,778,348 in net unrealized gains. Overall, the fund’s net assets declined by $17,273,066 after accounting for all inflows and outflows during the period.

Thus, we can clearly see that the Saba Capital Income & Opportunities Fund failed to cover the distributions fully that it paid out in the most recent six-month period. This comes on the heels of the fund’s failure to cover its distributions during the preceding year. As we can see here, the fund’s net asset value has also declined since the closing date of the most recent financial report:

Barchart

Thus, the fund has failed to cover its distributions over the past twenty months or so in aggregate. This is certainly concerning, and it suggests that the fund probably should reduce its distribution. It might have to at some point if this problem is not corrected.

Valuation

Shares of the Saba Capital Income & Opportunities Fund are currently trading at a 6.58% discount to net asset value. This is considerably more expensive than the 8.85% discount that shares of the fund have had on average over the past month. Thus, it might be possible to obtain a more attractive price by waiting for a short period of time before purchasing shares.

Conclusion

In conclusion, the Saba Capital Income & Opportunities Fund is a fairly unique closed-end fund that invests in vastly different types of assets than most other closed-end funds. This appears to have worked against the fund recently, as its exposure to catastrophe bonds might have caused it to suffer fairly substantial losses last month. Admittedly, it is uncertain whether that exposure was the cause of the net asset value decline, but there is not really anything else in its portfolio that could have had such a significant impact. This will hopefully only be a temporary problem that the fund will recover from after the summer. The bigger problem here is that this fund appears to be over-distributing and might end up having to cut its distribution at some point in the future because, otherwise, it will run out of money.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply