One of the more interesting stocks in my portfolio is Intel Corporation (NASDAQ:INTC) right now. But we could call that also a nice way to frame what is true as well: an investment in Intel has been catastrophic in the last few months. In my last article about Intel – published in January 2024 – I was a bit cautious (in an overall rather bullish article) and wrote:

But while Intel could decline as well in the next few quarters, I see Intel trading for higher prices when using a time horizon of 5 to 10 years (compared to the stock market which is headed for a “lost decade”).

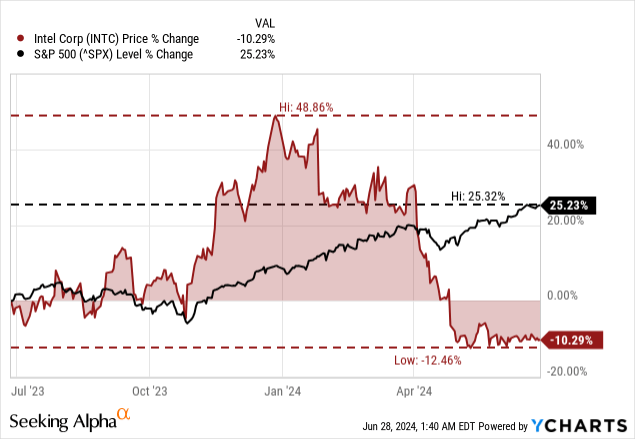

But now when looking at the chart, we don’t see Intel outperforming the overall market anymore. Instead, Intel lost about 10% in the last 12 months while the S&P 500 gained 25% in the same timeframe and the outperformance of Intel dissolved into thin air.

And it is not surprising that stocks are correcting from time to time. An upward wave is always followed by a corrective downward wave. Following the doubling in value, a correction for Intel is not surprising, but I did not expect the stock to drop 40%, which is not a small correction anymore.

Hence, it is time to take a closer look at Intel again and make a decision whether to hold on to Intel as a long-term investment or if it is time to pull the ripcord as long as I still can make a profit with my Intel investment. In the following article, I try to look at Intel from several different angles to get a complete picture, and we start with the latest quarterly results.

Quarterly Results

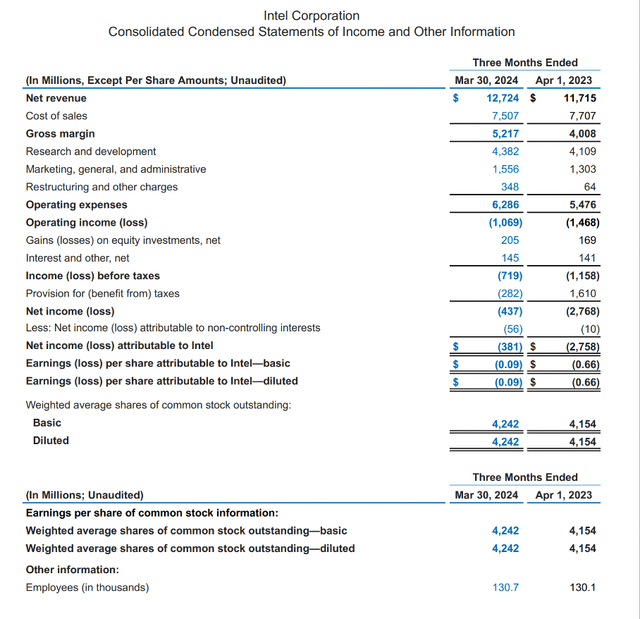

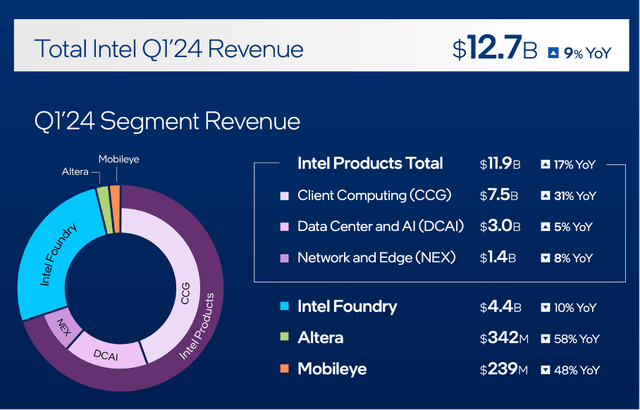

Intel reported its last quarterly results about two months ago, at the end of April. And in the last few quarters, results have seldom been great for Intel. However, after the last two quarters that were a little bit better, I consider the first quarter results for fiscal 2024 a particular disappointment once again. The company actually did beat earnings expectations (but on a non-GAAP basis) and slightly missed revenue expectations. And net revenue increased from $11,715 million in Q1/23 to $12,724 million in Q1/24 resulting in 8.6% year-over-year growth.

Intel Earnings Release Q1/24

While top line is growing with a solid pace, Intel once again had to report an operating loss of $1,069 million. We can point out that the operating loss in the same quarter last year was $1,468 million, and we therefore see an improvement, but a loss is still a loss. And looking at the bottom line, the picture is the same – diluted loss per share improved from $0.66 in the same quarter last year to $0.09 this quarter, but we are still dealing with a company not being able to constantly report positive earnings.

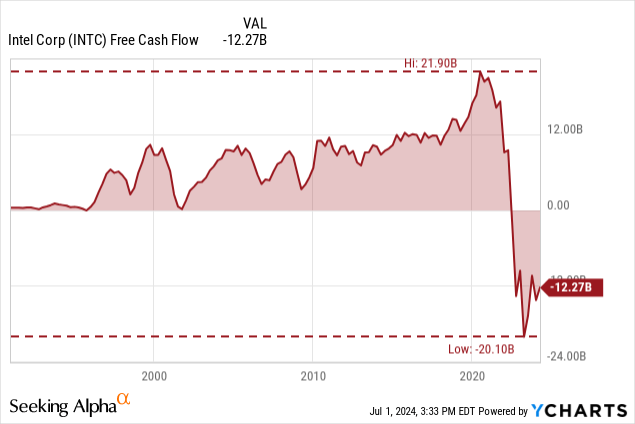

Especially, adjusted free cash flow is a huge disappointment. Although we see an improvement as well – $6,178 in negative free cash flow in Q1/24 compared to $8,764 million in Q1/23 the trailing twelve months free cash flow continues to be negative, which will be more and more a problem the longer this situation lasts.

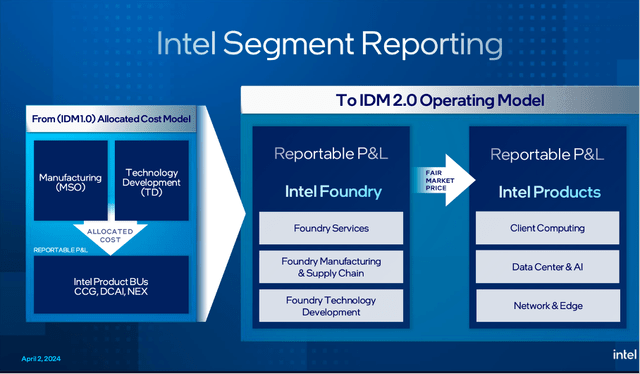

New Reporting Structure

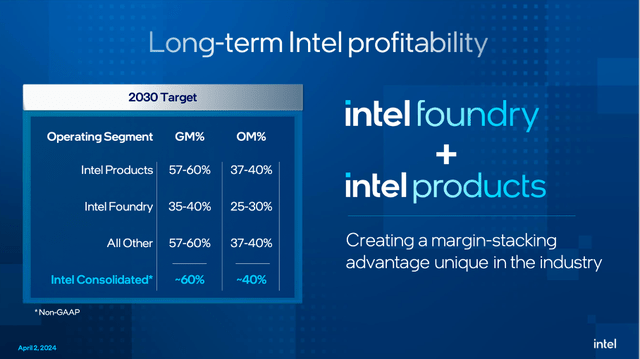

Intel is now reporting in two major segments – Intel Foundry and Intel Products. This way, Intel wants to differentiate more between the Intel Products business which is performing in an acceptable way and is at least profitable as well as the Intel Foundry business, which is not profitable yet but actually generating a huge operating loss. Geisinger is also pointing out that the new structure is providing transparency, accountability and is providing incentives to both groups to make better decisions for a better cost structure of their own.

Intel New Segment Reporting Webinar

And when looking at Intel’s core business – Intel Products – we see revenue increasing from $10,157 million in the same quarter last year to $11,933 million this quarter. This could be seen as a good sign and 17.5% year-over-year growth for revenue is certainly good, but to be honest, it is just showing the fluctuation of semiconductors and the cyclicality of the business.

Intel Q1/24 Infographic

And when looking not only at the core business, it is especially Mobileye and Altera worth mentioning.

Altera

As long as we are talking about the new business structure and the different segments, we can also talk about the new segment Altera. The company had already announced its intent to operate Altera as a standalone business beginning in the first quarter of 2024. Previously, it was included in the DCAI segment. In the first quarter of fiscal 2024, the segment reported $342 million in revenue and compared to $816 million in revenue the segment generated in the same quarter last year, this is a 58.1% year-over-year decline.

And management has similar plans for Altera as it had for Mobileye. CEO Pat Gelsinger stated during the earnings call:

This quarter, we formally rebranded our programmable solutions group, Altera, an Intel company. We look forward to bringing in a private equity partner this year to help prepare the company for an IPO in the coming years. This puts Altera on a similar path as Mobileye.

Mobileye Global Inc. (MBLY)

In the past, Mobileye was one of the few segments growing with a solid pace. But now in Q1/24, revenue crashed, and it generated only $239 million compared to $458 million in the same quarter last year. This is resulting in 47.8% year-over-year decline. And instead of an operating income of $123 million in the same quarter last year, the segment now reported an operating loss of $68 million. The reasons for the horrible performance of Mobileye was a drawdown of inventory of major customers of Mobileye.

Nevertheless, Mobileye reiterated full-year guidance during the last earnings call as financial results are expected to recover quickly. For fiscal 2024, earnings expectations are only $0.38 (compared to $0.82 in the previous year) and revenue is expected to be $1.89 billion (compared to $2.08 billion). But for the following years, analysts are expecting high double-digit growth rates for revenue as well as earnings per share.

Long-Term Vision

The semiconductor industry seems to be split in two groups right now. On the one side we have high-flyers like NVIDIA Corporation (NVDA), on the other side we have companies like Intel that are clearly struggling (business and share price). However, for the semiconductor companies the long-term bullish arguments stay the same. Not only are semiconductors becoming more and more important in the years to come, and the demand will mostly likely rise, but there are also only a few companies in the world being able to manufacture these (including Intel). Additionally, with international conflicts heating up, more and more Western countries might not want to be dependent on Asian companies and Intel can produce key components in the United States.

During the last earnings call, Pat Gelsinger pointed out that there is only a handful of companies being able to do what Intel does. During the earnings call, Gelsinger said:

Yes, we have a lot of hard work in front of us, but we know what we need to do and the payoff will be significant in the end. Semiconductors are the currency that will drive the global economy for decades to come. We are one of two, maybe three companies in the world, that can continue to enable next-generation chip technologies and the only one that has Western capacity in R&D. And we will participate in the entire AI market. Quarter-by-quarter, we are positioning ourselves well to capitalize on the immense opportunities ahead.

And when talking about the growth potential, especially for Intel, we can mention Intel Foundry on which expectations are relying when talking about future growth.

During the earnings call, management explained the optimistic expectations it has for the years to come. The foundry market is expected to grow from $110 billion today to $240 billion by 2030. And these are not only optimistic expectations by management but can be backed up by several studies. According to a study by Credence Research, the market is expected to grow with a CAGR of 8% until 2030 to reach $238 billion in revenue. Allied Market Research has a little lower target of $232 billion in 2032.

Gelsinger also commented on targets and potential revenue in the years to come:

Put it another way, our 15 billion of external revenue embedded in our Intel Foundry target model would represent less than 15% of the leading-edge foundry market. It is not a question of if, but when Intel Foundry achieves escape velocity. And every day, we are proving to the market that Intel Foundry is a resilient, sustainable and trusted alternative to serve a semi-market on a path to top 1 trillion by the end of the decade.

And long-term (2030 target) Intel is expecting operating margins for the Intel Foundry business to be somewhere between 25% and 30% and this segment contributing to profitability for the overall business.

Intel New Segment Reporting Webinar

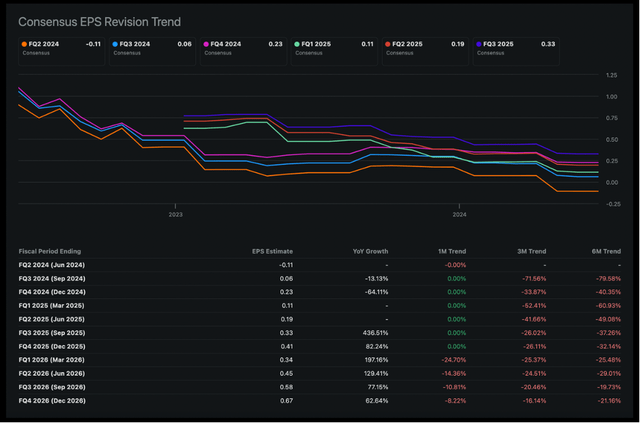

When looking at analysts’ estimates for the next few years, we can see some level of optimism and analysts still being confident Intel can manage the turnaround and at least reach previous highs again. Earnings per share are expected to grow with a high pace in the next few years, but we also must keep in mind that current earnings per share are extremely low, and it should be rather easy for Intel to grow starting from such a low basis.

Intel Struggling, Intel Lagging

And despite all optimism over the next few years and earnings per share growing again, we also must take into account that analysts constantly lowered estimates for the coming quarters.

Intel: Consensus EPS Revisions (Seeking Alpha Earnings Estimates)

And so far, no bottom is in sight, with estimates being lowered at least every quarter. This is also reflecting the sentiment surrounding Intel right now. And when looking at sentiment, the market seems to be split between extremely bearish sentiment surrounding Intel and extremely bullish sentiment surrounding other semiconductor companies – especially NVIDIA.

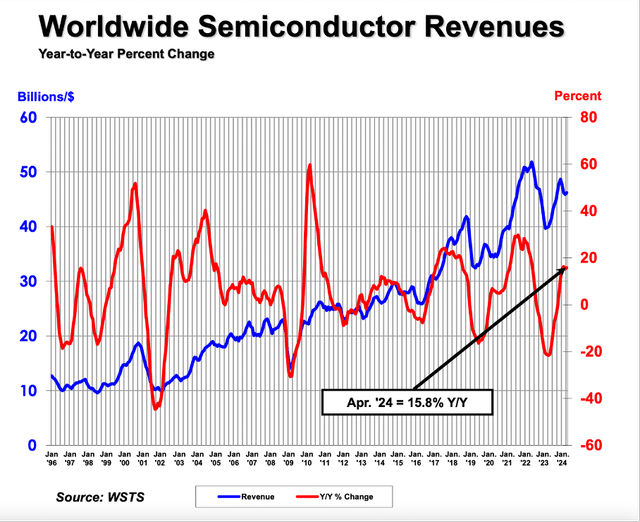

But we should not forget that other semiconductor companies were also struggling in the last few quarters and not just Intel reported terrible results. The entire semiconductor industry was struggling in the last few years and did not reach previous highs again.

Semiconductor Industry Association

However, when looking at the last data from the Semiconductor Industry Association, global semiconductor sales are growing at a high double-digit pace again and Intel should now continue to grow as well. In the coming quarters, we should expect Intel to grow at a high pace as well, and it would rather be a disappointment if Intel did not follow its peers. But as mentioned above, Intel’s core business – Intel Products – already grew in the double digits in the last quarter. But especially Mobileye and Altera should return to the path of growth. And according to the Semiconductor Industry Association, the overall market is expected to grow 16% in 2024.

But we also must point out that Intel constantly missed out on many innovations over the past decade – especially when compared to NVIDIA and its innovation in the AI semiconductor space, and what was once the leader in the industry is now rather paying catch up to its competitors. Nevertheless, Pat Gelsinger is showing a lot of optimism and is expecting Q1 to be the bottom:

While first-half trends are modestly weaker than we originally anticipated, they are consistent with what others have said and also reflect some of our own near-term supply constraints. We continue to see Q1 as the bottom and we expect sequential revenue growth to strengthen throughout the year and into 2025, underpinned by, one, the beginnings of an enterprise refresh cycle and growing momentum for AIPCs. Two, a data center recovery with a return to more normal CPU buying patterns and ramping of our accelerator offerings. And three, cyclical recoveries in NEX, Mobileye and Altera.

Intel: Better Investment

When considering Intel lagging in the last few years, missing out on innovation and sentiment being extremely bearish, it is difficult to argue for Intel being a good investment. But especially due to the extremely negative sentiment, I would argue for Intel being a good investment at this point – and a much better investment than NVIDIA.

Nobody is expecting anything from Intel, and even the slightest growth in the years to come will make Intel a good investment. NVIDIA, on the other hand, is priced for perfection, and it seems unlikely that investors will make money over the next ten years even if NVIDIA will continue to grow with a high pace. And I already explained in my last two articles why NVIDIA is at a high risk of growth rates coming down again. Part of the reason could be that a first AI spending cycle for the early movers (big tech companies) might be over soon and with a potential recession on the horizon, many companies rather must cut expenses. Another major reason is competition – and this is including Intel – catching up with NVIDIA and taking market share again (even if this might take some time).

Conclusion

Overall, I see Intel at a cyclical low and expect higher stock prices in the coming quarters. Of course, for this to happen, the extremely bearish sentiment has to change again, but extremely bearish sentiment can also be seen as a contra-indicator and actually pointing towards higher stock prices.

And I will not repeat my arguments why Intel is undervalued at this point. The stock price is reflecting so much negativity that even a mediocre performance of Intel is enough to make the stock a good investment in my opinion.

Read the full article here

Leave a Reply